Trickle-Down Trumpnomics

During this year’s General Assembly session, the House of Delegates created an emergency committee tasked with investigating the impact of federal cuts on Virginia. This group met for a third time this week. As you might imagine, Democrats on the committee were more pessimistic about the economic future for Virginians, while the Republicans had a more rosy picture.

The topics discussed by presenters ranged from potential cuts to Medicaid and access to health care, to tourism, to tariffs and Virginia’s agricultural exports to China, increase in traffic at food pantries across the Southwest region, and how frozen federal grants affect food security, among others during the roughly 5-hour meeting. Overall, the meeting reinforced how rural communities are being hit hardest by federal cuts, particularly in the area of food service and economic development. Some grants have been frozen, terminated, or paused and then restarted. Those grants include:

$42.5 million cooperative agreement, which includes 17 partners who provide support for farmers and food entrepreneurs across seven Appalachian states. This grant has been frozen since the Trump administration took office and is expected to affect 300 food businesses and 180 farmers;

$7.6 million federal pass-through grant for fiscal year 2025 from the Virginia Department of Agricultural and Consumer services was terminated. This action is expected to cause agricultural producers to lose millions in sales, and people in need will no longer receive fresh food through the agency’s food box program;

$500,000 grant has been terminated that would have provided direct financial assistance for the establishment of agroforestry practices to diversify farm income, increase yields, and improve resilience to challenging weather.

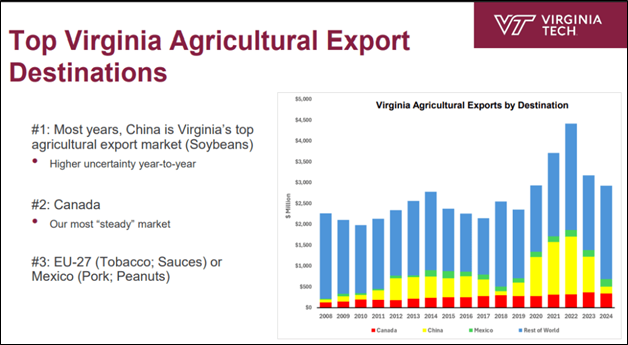

This slide (which was presented at the meeting) shows the potential economic impact of Trump’s on-again-off-again trade war with China, where the uncertainty itself is causing a market upheaval.

The U.S. House Energy and Commerce Committee spending bill was also the topic of some discussion, although since it was released only on Sunday (the day before the meeting) it had not yet been read fully by everyone at the meeting. One of the topics discussed at the meeting was the proposed $800 billion cut over 10 years, including significant cuts to Medicaid. Congress is also anticipated to add work requirements for those seeking coverage through Medicaid.

A quick note on work requirements. This sounds good, but it wouldn’t be much of a cost saving, for several reasons:

Most Medicaid spending goes to groups not subject to work requirements

Elderly individuals (often in nursing homes)

People with disabilities

Children

Pregnant women

Low-income adults are either already working, or are caregivers, students, or unable to work due to health or logistical barriers. A Kaiser Family Foundation found that 60% of Medicaid adults without disabilities are employed, and most others face legitimate barriers to employment. They are receiving Medicaid because they do not earn enough at their jobs to be able to afford other health insurance.

Implementing and monitoring work requirements introduce new administration costs which can offset or exceed any savings from reduced enrollment. In 2018, for example, Arkansas imposed work requirements which led to thousands losing coverage. But there was no clear increase in employment and it cost the state a loss to administer the policy.

Reducing Medicaid coverage may decrease spending in the short term, but uninsured people often delay care, which leads to worse outcomes and higher costs for hospitals and states.’

On yesterday’s Pod Save the World episode, the co-hosts spent some time talking about this part of the budget bill, concluding that the purpose is to score political points (because adding work requirements seems like a no-brainer until you think about it more deeply) and achieve some budget cuts because the red-tape burden of proving that you are eligible for Medicaid benefits means that a projected 8-10 million eligible Americans will not receive benefits.

And let’s not forget that all of this cost-cutting (including the DOGE sledgehammer cuts) is being undertaken so that the President’s budget can meet the demands of the reconciliation process while extending his 2017 tax cuts that provided the greatest tax savings to the people in the United States with the highest incomes.

We need to factor in another consideration. Many rural hospitals and long-term care homes depend heavily on people who are on Medicaid. If Medicaid reimbursements go down, these hospitals (which are already operating on shoestring budgets) will close down. This will impact not only people on Medicaid — it will impact people on every other form of health insurance. It is estimated that somewhere around 1,000 rural healthcare facilities will close down if 10 million people currently on Medicaid become ineligible.

Other concerns raised at the meeting including increased claims for unemployment insurance from fired federal workers and fired employees of federal contractors. These numbers are expected to go up as some of the halted DOGE cuts become permanent and as other people decide that the uncertainty of government employment is too stressful.

What’s happening in Virginia is being replicated in other states across the country.

It’s crazy!