Prove Me Wrong

So here’s the deal with governments. In theory, governments do things for people because it’s too expensive or too inefficient for people to do them for themselves. I mean, we could all create our own road to the grocery store or create our own sewage systems, but they wouldn’t work very well and would cost a lot.

This is the reason we agree to give a portion of our money to our government. We expect the government to spend our money doing things we generally think are worth doing. Now, most of us pay little attention to the vast array of government programs out there, but one consistent reality is that these programs exist because some groups of Americans asked their elected representatives to create them. We hand over our economic power to elected representatives, assuming that we will reap the benefits of some of the programs and that society as a whole will benefit from the totality of the programs.

I don’t think anyone likes everything the government does, but we like enough things that we tolerate the idea that other people may have different preferences than us and that the government may respond to them as well.

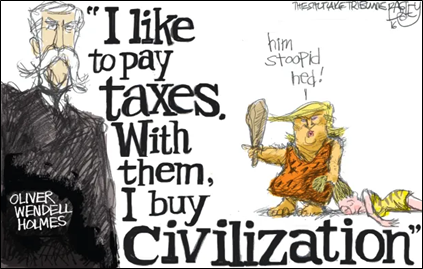

So that’s the way the system works – or is supposed to work – and it has generally worked for the 238 years since the ratification of the constitution in 1787. For over a hundred years, the government has been funded primarily by income taxes, and, while we’ve all griped about high taxes, we pay them as the price of civilization.

But now it appears that that centuries-long contract is being destroyed. One individual – Elon Musk – has persuaded the dotard in the White House that he and he alone is wise enough to decide what the government spends its money on. By attempting to demolish independent federal agencies that spend less than .1% of the federal budget (USAID) or abolishing the Department of Education while increasing spending for the Department of Defense (with which Elon has contracts), Musk is reorienting government budget priorities. That, of course, is the job of Congress – our elected representatives.

So I have a radical idea. It’s tax season, right? You’ve probably received a few W-2 forms telling you how much of your income has been withheld to pay your income taxes this year. You’re probably in the process of putting all that information together to file your tax returns in the next month or so.

Here’s my proposal: Let’s not pay income taxes or file tax returns this year.

CAVEAT: I’m no lawyer, so this may have some legal consequences. You have been warned.

I also don’t have any idea about exactly how to do this. I mean, they keep the money that’s been withheld even if we don’t file our taxes, right? Do any of you have any better ideas about this?

But hear me out. We only give the government a portion of our money because they promise to spend it on programs legitimately funded by our elected representatives in Congress. If this is no longer the way the government is funded – if they have broken the contract – then we have no obligation to support it.

Prove me wrong.

I'd join you, Karen, except that I have heard that the Powhatan Correctional Facility for Women has terrible food and they make you work in the laundry. I'm still planning to stay retired, thank you very much. There are still a couple of possibilities ... 1) a few R's get their heads out of the sand and vote with the D's or 2) the Supremes decide that the Constitution is more important than the Felon-in-charge and his boyfriend. One can only hope.

There are many reasons your suggestions will just make things worse for you - unless they fire everyone at the IRS and no one is there to make sure you comply.

1. Penalties for non-payment - https://www.irs.gov/payments/underpayment-of-estimated-tax-by-individuals-penalty

2. Failure to files penalties (note you may file for an extension, but more penalties apply if you will owe taxes when you do file) https://www.irs.gov/payments/failure-to-file-penalty

I comply with the law and make payments quarterly (state and federal). I try not to overpay my taxes and hit the sweet spot between the amount I owe and an amount that won't trigger penalties. The last thing I want to do is have to pay even more to the government.

I am not a tax attorney nor a CPA but I have a history in accounting and have prepared tax returns for myself and for others. This kind of civil disobedience is not one I would suggest. https://www.irs.gov/privacy-disclosure/the-truth-about-frivolous-tax-arguments-section-i-d-to-e

So this won't help me...they already have my money!