He's Wrong About Tariffs, Too

We shouldn’t be surprised that #P01135809 is wrong about tariffs. He’s famously wrong about everything. I want to spend a bit of time today explaining how tariffs work.

NOTE: His economic advisors know that he’s wrong about tariffs. The GOP leadership in Congress knows he’s wrong about tariffs. But they don’t care. We shouldn’t still be astonished by this, but they really don’t care.

Settle in for a little microeconomics. We’re going to be looking at supply and demand curves to understand who pays for tariffs and who benefits from them.

Many online sources help explain how tariffs work, including some YouTube videos that walk you through the explanation. I’ll provide those links at the end of this essay.

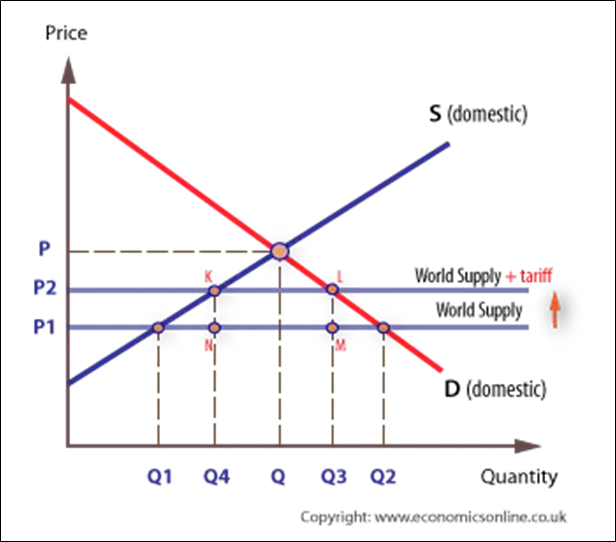

This is a standard supply and demand curve that economists use to explain how prices rise and fall in relationship to what consumers are willing to purchase and what suppliers are willing to produce at any given price point. Logically, the demand curve slopes downward – the quantity people are willing to purchase increases as the cost goes down, The supply curve slopes upward – producers are willing to produce and sell more if they can get a higher price for their products.

The domestic market for widgets is explained by the Demand curve (D) and the Supply curve (S). However, widgets can often be produced more cheaply in other countries; this sets a world supply level. At this price level (P1), American producers are willing to sell a smaller quantity of widgets (Q1), while American consumers are willing to purchase a larger quantity of widgets (Q2). The United States will widgets to fill in the quantity demanded by imported the difference between Q1 and Q2.

But suppose a president or other economic policymakers want to support American manufacturing? They can do this by adding a tariff, which will be layered in on top of the world supply price. This changes the world supply price to American importers to P2. At this price, the quantity of widgets made domestically will go up to Q4 while the price to consumers goes up to P2. Widgets will still be imported, but the quantity imported will now be the difference between Q4 and Q3.

Got it?

#P01135809 boasts ALL THE TIME that “China pays when the US imposes a tariff on imports from China.

That is incorrect. Enormously incorrect. Flunk-out-of-school incorrect.

A tariff is, by and large, a sales tax. In the case of a tariff, the tax is paid by the importer (think a wholesaler or a big box store like Walmart or Costco). A tariff is never paid by the exporting country. The tariff is collected from the importer at the point of entry by the United States Government Customs and Border Protection Agency under the Department of Homeland Security.

#P01135809’s brainless idea of imposing a 10% tariff on “everything” is wildly irresponsible. It would create supercharged inflation, crater investment markets, and make the United States an international pariah. Most products labeled “Made in America” incorporate imported parts; a tariff would raise prices on US widgets as well as imported widgets.

There are some advantages to tariffs:

They protect domestic industries from competition by cheaper imported goods. This can be a good thing in the short run. By protecting what some call “infant industries,” tariffs can provide some breathing room for an industry that is working to catch up to world production standards but would be unprofitable if it had to compete with imports.

Protecting domestic production also protects domestic jobs. The various exhortations to “buy local” reflect our general awareness that buying products made by domestic producers is good for American industry. But there’s a reason why Costco and Walmart are wildly profitable. Consumers support local businesses in principle, but they buy their stuff at the cheapest price the can find.

Tariffs help balance both the domestic and international economy. Domestically, increased production adds to taxes paid by businesses and workers, thus offsetting a portion of federal budget deficits. Internationally, fewer imports mean less money flowing out of the country and more money staying put. When there are fewer dollars on the world financial exchanges, the value of the dollar in comparison to other currencies goes up. When the value of the dollar goes up, the prices that Americans pay for goods produced in other countries go down. This doesn’t refer only to imported goods that people purchase in the US; it applies to foreign goods that Americans purchase when they travel abroad. A strong dollar (meaning a dollar with greater trade value) means cheaper prices for meals, hotels, and refrigerator magnets for American tourists abroad.

However, the negative consequences of tariffs are much more certain and more costly.

The first negative is that increased taxes (tariffs) increase prices. Importers will pass the increases along to consumers. They may absorb a portion of the increase, but there is no doubt that tariffs increase prices.

Tariffs imposed by the United States discourage widget producers in other countries from exporting their product to the United States. They will sell it elsewhere, leading to domestic shortages of widgets. Since people still demand widgets, domestic producers will be able to raise their prices even higher. The consumers will suffer.

Meanwhile, tariffs will shrink the global widget supply for American consumers. It won’t look like just a reduction in the number of widgets; it will extend to a reduction in the variety of widgets Americans will be able to buy.

Efficiency is impaired by tariffs. When domestic widget producers realize that they are protected from foreign competition, they will be less worried about cost cutting measures that would allow them to bring down their own prices. American consumers will foot the bill while widget manufacturers pad their corporate benefit packages.

It is also important to recognize that tariffs are a double-edged sword. Countries frequently respond to targeted tariffs with retaliatory tariffs. If #P01135809 or someone like #P01135809 (is there really anyone like #P01135809) is successful in imposing these ruinous tariffs on imports from China (for example), there is a very real likelihood that China would impose tariffs on American exports to China. China is the third largest export market for the United States (after Canada and Mexico), and the value of US exports to China $147.81 Billion. Texas, California, Oregon, Illinois, and South Carolina were the five states with the highest value of goods exported to China. #P01135809 can’t win the Presidency without Texas and South Carolina. Just sayin’.

Here’s how one source describes trade between these five states and China

Soybeans, semiconductors, pharmaceutical preparations, industrial machines, and crude oil were among the most exported commodities to China. The theory of comparative advantage suggests that under the condition of international trade, countries could profit from the specialization in the production of goods that they are relatively efficient in producing. The United States’ comparative advantage over China lies in high-tech manufacturing and agricultural products, reflected in the leading export categories to China. California, home to numerous technology enterprises, exports electronics such as semiconductors to China to be inserted into mobile phones. Exports from Washington to China are dominated by the aerospace sector, as it is home to significant assembly sites of Boeing. By comparison, China’s comparative advantage lies largely in labor-intensive, manufactured goods.

We should not be surprised that #P01135809 is wrong about tariffs. As I said at the beginning of this essay, he’s wrong about everything.

Tell your friends.

Here are some of the links I promised you at the beginning of this essay.

https://www.economicsonline.co.uk/global_economics/tariffs_and_quotas.html/

https://www.reviewecon.com/trade-tariffs

Well done. Too bad idiot boy doesn't read.