Countering the Spin

Ever since the 34 guilty verdicts were delivered last Friday, I’ve been trying to figure out what to write about this historic event. Fortunately, people who are smarter and more focused than me (Judd Legum and Joyce Vance, to name just two) have also been working on this. I’ve put together their insights and added a couple of my own. If you want to read what they had to say, you can find their full analyses here and here.

What follows is a list of some of the incorrect claims #P91135809’s supporters are making, followed by the factual information that rebuts their claims. I’ve included the links the original authors provided in their essays so you can go deeper into all of these issues.

Myth:

The most common argument is that the charges against #P01135809 were “obscure” and “entirely unprecedented.”

Response:

On the most basic level, this is false. The same office has prosecuted dozens of cases of first-degree falsification of business records over the last 15 years. It's the bread and butter of the Manhattan DA. It is true that prosecuting someone for falsifying business records to conceal a campaign finance violation is uncommon — but that is because the crime itself is uncommon. There are not that many people who run for political office in New York who also run their own businesses. And even fewer who falsify business records as part of a conspiracy to conceal violations of campaign finance law to help them win. The idea that the prosecution is unusual is important only if it suggests that the government routinely lets others get away with similar conduct. There is no evidence suggesting that this is true.

Myth:

Marco Rubio and others have claimed that prosecutors didn't reveal their legal theory against #P01135809 until closing arguments.

Response:

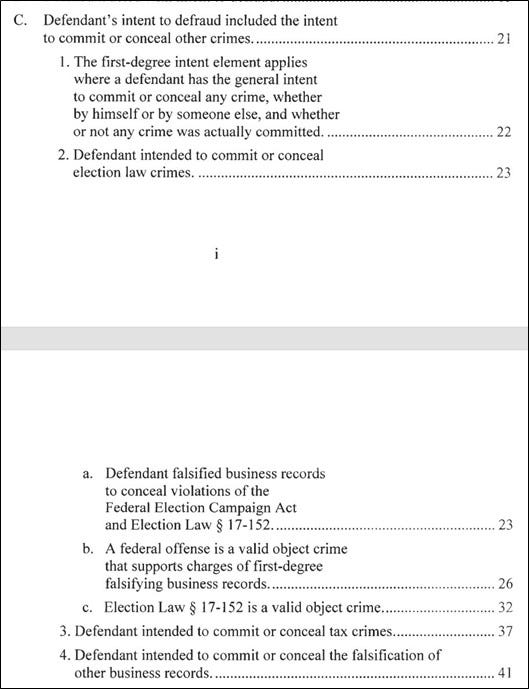

This is false. #P91135809 was charged in a 15-page indictment, handed up by a grand jury, with 34 counts of violating New York Penal Law 175-10 in the first degree, which is a felony. A violation in the first degree occurs when a person falsifies business records with an intent to defraud that includes an intent to commit, aid, or conceal another crime. In addition to the indictment, the Manhattan District Attorney filed a 13-page statement of facts detailing the allegations. The verdict required the jury to find that #P01135809 falsified business records to conceal an intent to commit another crime. The specifics of the prosecutors' theory were disclosed in great detail in a November 2023 legal filing.

Myth: Prosecutors stretched the law to convert a misdemeanor into a felony.

Response: Under New York law, a simple falsification of business records without any intent to commit or conceal another crime is a violation of the statute in the second degree, punishable as a misdemeanor.

An intent to conceal another crime is an aggravating factor that brings enhanced penalties, such as a felony. This law containing degrees of severity was enacted by the New York legislature, and it is a common way of structuring laws with escalating penalties for more egregious violations. (For example, penalties for federal drug offenses range from misdemeanors for simple possession to lengthy terms of imprisonment for aggravating factors based on quantity or intent to distribute.) The grand jury found probable cause for 34 violations in the first degree, and the trial jury found proof of these crimes beyond a reasonable doubt.

Myth:

Fox News’ John Roberts (among others) claimed the judge instructed the jury that they did not need to reach a unanimous verdict to convict #P01135809.

Response:

This is false "Your verdict, on each count you consider, whether guilty or not guilty, must be unanimous," Merchan said.

The New York statute on "Conspiracy to promote or prevent election" requires the violator to conspire to promote a candidate by "illegal means." Prosecutors argued that the conspiracy to promote #P01135809 involved three illegal acts: "(1) violations of the Federal Election Campaign Act otherwise known as FECA; (2) the falsification of other business records; or (3) violation of tax laws."

Judge Merchan instructed the jury that New York law does not require the jury to be unanimous as to "what those illegal means were." This is an accurate description of New York law. If Merchan were to have instructed the jury that they all needed to agree on one of the three potential illegal acts in order to convict, he would be making up a new law just for #P01135809.

While the indictment specified each of the checks, invoices, and ledger entries alleged to have been falsified, it did not specify which crime #P91135809 allegedly concealed. A defendant is entitled to fair notice of the crime with which he is charged so that he can effectively defend himself at trial, but New York law does not require this level of specificity in the charging document. New York case law requires that the indictment allege only a general intent to conceal a crime, not an intent to conceal a specific crime.

Nonetheless, prosecutors provided this specificity in a prosecution filing in November 2023, five months before his trial began. In that filing, prosecutors disclosed that the crimes they alleged #P91135809 intended to conceal were violating state and federal campaign finance laws and violating state tax laws. The court rejected an additional basis offered by the prosecution, falsifying business records outside the #P91135809 organization.

My note: This is a quirk of New York law that sounds a little sketchy to me. This will undoubtedly be at least one basis for #P01135809’s appeal. But it is inaccurate to claim that the judge did not apply the law appropriately. He did. That’s his job.

Myth: Justice Juan Merchan violated #P91135809’s rights to defend himself by refusing to permit him to call an expert witness.

Response: In #P91135809’s defense, he wanted to call Brad Smith, a former member of the Federal Election Commission, as an expert witness on federal election law. Expert witnesses are permitted to testify in trials to assist the jury in understanding facts about matters beyond ordinary understanding. Matters of law, in contrast, are for the judge to provide.

Justice Merchan did not prohibit Smith from testifying, but when he ruled that he could testify only about facts, and not law, #P91135809’s team decided not to call him as a witness. Contrary to this myth, Justice Merchan would have erred if he had permitted #P91135809 to call an expert witness to testify about the law.

Myth:

This is also about Brad Smith, whose testimony would have argued that the payments to Daniels did not violate federal campaign finance law because the money could be considered a personal expense, not a campaign expense.

Response:

Smith ignores testimony from former AMI CEO David Pecker that there was an agreement to make these kinds of payments to protect #P01135809's campaign.

But there is a bigger problem with Smith's argument. The prosecution did not just argue that the payments to Daniels violated campaign finance law. They also argued that the money paid to former Playmate Karen McDougal violated campaign finance law and was part of the same conspiracy. And that money was not paid by Cohen, it was paid by AMI.

If this was a personal expense why would it be paid by a corporation and never reimbursed? Smith does not address the payment to McDougal at all.

Myth:

Congressman Nick Langworthy (R-NY) (among others) argues that the conviction can't be taken very seriously because prosecutors "found the venue" where #P01135809 "couldn’t win." In other words, the jury was hopelessly biased against #P01135809.

Response:

First, #P01135809 was tried in Manhattan because that was the locus of his crimes. If you don’t want to have a trial in New York City, you should not crime in New York City.

My note: If you want to accuse anti-#P91135809 people of venue shopping to find a place where it would be easier to convict him, I’d like to talk to you about U.S. District Judge Matthew Kacsmaryk in Texas and why so many cases restricting reproductive freedom find their way to his court. You can read about this here.

Second, the jury was selected through the normal process. #P91135809’s attorneys had the right (which they exercised) to dismiss some jurors in peremptory challenges and others “for cause.” This was after about ½ of the jury pool self-selected themselves out of the case because they didn’t think they would be able to be impartial. Both the prosecution and defense agreed to these processes and accepted the jury that was seated.

Through his attorneys, #P91135809 asked for a change of venue a couple of months ago. They claimed that pre-trial publicity about this case made it impossible for him to get a fair trial. Their claim was struck down over two points: one, that there is no indication that people in New York are more flooded with information about this case than people in other parts of the country; and two, that much of the pre-trial publicity was because #P91135809 couldn’t stop talking about the case.

Second, the jury included someone who reported getting most of their news from TRUTH SOCIAL, #P01135809's own social media network. And several jurors had nice things to say about #P01135809 during voir dire.

My Note: Later information revealed that the juror who reported he got news from Truth Social amended his statement to say that he “followed everything” and got information from Truth Social by following the Twitter account that reposts #P01135809’s posts from his own platform.

Myth:

#P91135809 would not have been charged for a mere bookkeeping error if his name were anything other than Donald J. #P91135809.

Response:

The Manhattan DA’s office has filed charges for falsification of business records 9,794 times since 2015. When announcing the charges, Bragg emphasized the importance of the integrity of business records in Manhattan, the “home to the country’s most significant business market.” He explained: “We cannot allow New York businesses to manipulate their records to cover up criminal conduct.” At the time of # P91135809’s indictment, Bragg had already filed 120 cases alleging violations of 175-10, all of them in the first degree based on the concealment or commission of another crime.

Myth: It was improper for a state prosecutor to charge a federal offense.

Response: The parties litigated this issue months before the trial and the court found that statutes outside of the laws of New York were proper bases to be considered “other crimes.” For example, case law has held that an offense under the New York statute prohibiting possession of a concealed weapon by a person who has been “previously convicted of any crime” may be proved by showing that the person was convicted of a crime in another state.

New York courts have also upheld the use of federal offenses as the predicate crimes in other cases involving the falsification of business records in the first degree, the very crime charged in #P91135809’s case.

Myth: There is nothing illegal about paying hush money, and famous people do it all the time.

Response:

Paying hush money itself is not a crime, but it is a crime to falsify business records. And it is a more serious crime to falsify business records with, as in this case, intent to conceal other crimes. These include violations of campaign finance laws, by accepting donations over the legal limit, and violations of tax laws, by inaccurately characterizing the payments as income.

Myth:

The charges were filed after lengthy delay to interfere with #P91135809’s campaign for president.

Response: While prosecutors have discretion as to whether and when charges should be filed, there is no evidence that this case was brought to interfere with an election. In fact, the trial court found that the reason for the delay in bringing charges was partly #P91135809’s own doing.

In 2018, the case was being investigated by the U.S. Attorney’s Office for the Southern District of New York, which convicted #P91135809’s lawyer, Michael Cohen, for the same conduct, and referred to #P91135809 in the charging document as “Individual-1.” For reasons unknown, federal prosecutors during the #P91135809 Administration did not bring charges against #P91135809. Once federal prosecutors closed their investigation, Bragg’s predecessor, Cyrus Vance, Jr., started this investigation but was delayed by #P91135809’s prolonged challenges to grand jury subpoenas for his financial records, taking his objections all the way to the U.S. Supreme Court.

When Vance retired and Bragg was elected, Bragg insisted on reviewing the evidence before deciding whether to continue with the case. Ultimately, he decided to go forward. All of these factors contributed to the delay.

Myth:

Justice Juan Merchan was biased because of his $35 financial contribution to Joe Biden and because of his daughter’s work as a democratic political consultant.

Response:

Justice Merchan sought an opinion from the New York Advisory Committee on Judicial Ethics, regarding both of these issues and received an opinion that he need not recuse himself from the case. The finding of #P91135809’s guilt was made by a jury that #P91135809’s lawyers helped select.

My Note: Now do Aileen Cannon in Florida, Clarence Thomas, Sam Alito, etc.

Myth:

Justice Merchan violated #P91135809’s First Amendment rights to free speech and to testify in his own defense by imposing a gag order in the case.

Response:

The gag order entered by Justice Merchan and upheld by the five-judge appeals division did not prevent #P91135809 from testifying in his own defense, a right Merchan expressly explained to #P91135809 in open court during the trial. #P91135809 had every right to do so, and chose to instead exercise his right to remain silent at trial.

The gag order restricted the defense from making statements outside of court that targeted witnesses, jurors, staff, and family members of the court and prosecution team, though not Justice Merchan or Bragg himself. The court of appeals found that the order properly protected witnesses and the fair administration of justice.

Myth:

The U.S. Supreme Court may intervene and overturn #P91135809’s conviction before his sentencing on July 11, which is four days before the GOP convention. House MAGA Speaker Mike Johnson went so far as to say that the Supreme Court must intervene in this case.

Response:

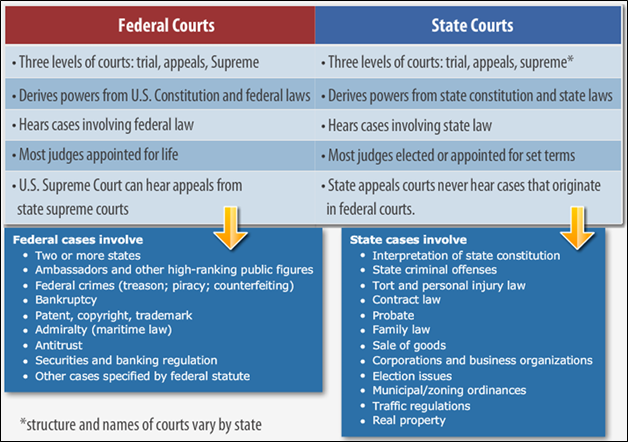

#P91135809 may appeal his conviction after he is sentenced on July 11. The case could not go before the U.S. Supreme Court until he exhausts all of his appeals in the New York state court system, which likely will take more than a year. Then, #P91135809 could ask the U.S. Supreme Court to review his case, but only for alleged errors applied to federal statutes or the U.S. Constitution, such as the due process clauses of the 5th and 14th Amendments. There is no mechanism for the Supremes to reach down into a state court proceeding and summarily overrule verdicts. Mike Johnson is a lawyer. He knows that. He just assumes you don’t.

I will add:

Myth:

President Biden ordered the prosecution of Donald #P91135809.

Response:

This case was tried in a state court in New York. The United States has a dual court system; the federal court system runs parallel to the court systems in the 50 states, and the two do not intersect except potentially at the Supreme Court level if cases get that far. Alvin Bragg was elected to his position as District Attorney (prosecutor) for the state court in Manhattan; he was not appointed by the Justice Department.

And if President Biden was willing to use the DOJ to control prosecutions (a power he most definitely could wield), don’t you think he would have done so to save his son, Hunter, who is currently on trial in Delaware on charges that are much flimsier than the charges on which #P91135809 was convicted?

We have to beat back these arguments whenever we encounter them. Put these on index cards and distribute them at grocery stores and restaurants.

To me, the biggest question is: what more will it take to remove #P91135809 from the ballot?

I'd love to post this on my Facebook feed, but the folks who need to read it won't, or won't believe it. 😐