Comparative Advantage

The current arguments over tariffs and government efficiency make me think of the economic concept of Comparative Advantage. This 19th-century concept described how one individual, firm, or country can produce a good or service at a lower opportunity cost than another.

· Opportunity cost is defined as the value of the next best alternative you forego when you make a decision – it represents what you give up when you choose one option over another

We implicitly understand this idea when we talk about not wanting to waste our time doing something that demands little or no skill when we should be doing something that demands the full reach of our talents. We might be better than someone else at both the low-skill and the high-skill task, but the principle of comparative advantage drives us to the high-skill task.

Here’s a simple example of how comparative advantage works in international trade.

This is a simplified example, because it’s focusing on only one of the factors of production – labor – whereas a real-world example would analyze the impact of variations of all of the factors of production (land, labor, capital, and entrepreneurship. It’s also focusing on only two commodities and two countries, where as real-world examples are much more complicated:

Step one:

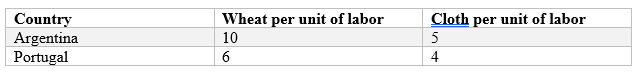

Let’s assume we have only two countries – Argentina and Portugal, say – producing two goods, wheat and cloth. Each country has a fixed amount of resources, and their production possibilities are as follows

(Note: these specific countries are for the purposes of example only. I don’t have any idea about whether Argentina or Portugal have an absolute or comparative advantage in wheat or cloth.):

Argentina has an absolute advantage in the production of both commodities, wheat and cloth. Its production process is more efficient for both Wheat and Cloth.

Step two: Calculate Opportunity costs

To determine comparative advantage, we calculate the opportunity cost of producing one unit of wheat or cloth in each country:

Argentina:

Opportunity cost of 1 Wheat = 5/10 = 0.5 Cloth

Opportunity cost of 1 Cloth = 10/5 = 2 Wheat

Portugal:

Opportunity cost of 1 Wheat = 4/6 = 0.67 Cloth

Opportunity cost of 1 Cloth = 6/4 = 1.5 Wheat

Step three: Calculate Comparative Advantage

Argentina has a lower opportunity cost in producing wheat (0.5 vs. .67).

Portugal has a lower opportunity cost in producing cloth (1.5 vs. 2).

Thus, Argentina has a comparative advantage in wheat and should specialize in producing wheat; Portugal has a comparative advantage in cloth and thus should specialize in producing cloth

This video from Khan Academy helps explain this. The beginning is a bit tedious, but it makes the point really well by the end.

Trump’s insistence on tariffs as a primary method of international economic relations means that the United States will not be able to operate outside of its production possibility frontier.

You’ll have to watch the video to understand this.

This second video takes the same concepts and applies them more specifically to the process of international trade. You should watch it too.

What? You got a better use for 10-15 minutes today?