I wrote this Wednesday morning before the “oopsie” news broke – that OMB rescinded the Executive Order that threw the country into chaos Tuesday. It’s a good time to quote F. Scott Fitzgerald in The Great Gatsby: “They were careless people, Tom and Daisy- they smashed up things and creatures and then retreated back into their money or their vast carelessness or whatever it was that kept them together, and let other people clean up the mess they had made.” Because Trump 2.0 is likely to do something similarly ignorant with government spending sometime soon, this explainer will still be valuable

Okay, Wednesday afternoon here so I have an update on the update. The president rescinded the OMB memo, not the President’s Executive Order. So everyone totally understands what’s going on here, right?

Macroeconomics is a balancing act. GDP, Employment, and inflation move together.

A growing economy creates more jobs, which creates more spending power. As more people spend money, increased demand drives up prices. If GDP rises, the supply of goods to purchase goes up, generating downward pressure on prices. The fragile equilibrium creates economic stability, which increases consumer confidence. Consumer confidence means that people are less concerned about saving for an upcoming economic disaster and more willing to spend in the present. They spend more money, encouraging producers to make more things to sell. And the cycle continues.

A stagnant economy has the reverse effect. Job growth flattens, spending power decreases, prices go down, suppliers have reduced revenue, they cut production, and the cycle continues. Consumers fear job loss and decreased income, so they have less confidence in their economic future. Reduced consumer confidence means they save for the upcoming rainy day, spending even less in the present. And the cycle continues.

These relationships are a self-fulfilling prophecy. If people believe the economy is doing well, they will spend money, thus increasing demand which increases suppliers’ willingness to make more stuff for people to buy. That stimulates the job market, leading to higher employment and more money for people to spend — resulting in a strong economy. If people believe the economy is doing poorly, they will reverse all of these actions, resulting in the very thing they feared — a stagnant economy.

I’m writing about this today because of this week’s edition of Trump Turmoil, in which he froze government spending across the board, utilizing power that he doesn’t have to create chaos – which is the point. But his actions have real-life consequences for the economic stability of the United States and the world.

According to the Commerce Department’s Bureau of Economic Analysis, Government consumption expenditures and gross investment generally comprise 17-20% of US GDP. This includes spending on defense, infrastructure, education, public health, and administration. In addition, government contracting supports private-sector industries such as defense, healthcare, and construction. Government spending on Social Security, Medicare, Medicaid, and unemployment benefits increases household income and consumption. These programs boost demand, indirectly contributing to GDP.

Then there is the multiplier effect. Let’s assume the marginal propensity to consume is 80%. This means that everyone in this example spends 80% and saves 20% of their income. Now, suppose the government decides to spend $1,000 to maintain a park in a small town. It hires a local contractor to do the work. When he is paid the $1,000, he spends $800 to pay his workers and to buy groceries. His workers and the grocery store owners turn around and spend $640 to buy supplies or pay staff. The people who receive the $600 spend $512 on various expenditures. And so on until there’s nothing left.

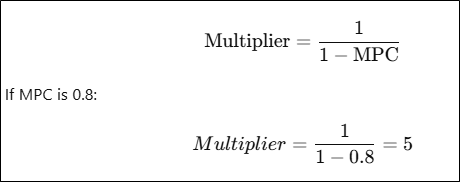

The initial government expenditure of $1,000 has generated $1,000 + $800 + $640 + $512 + (increasingly smaller amount until you get close to $0). The formula for calculating the multiplier looks like this.

This means that the initial government expenditure of $1,000 generates $5,000 of economic activity. GDP – the total amount of economic activity in a nation – is calculated this way:

GDP = Consumption + investment + Government Spending + (exports-imports). The initial government expenditure and all of the subsequent expenditures go into the calculation of GDP.

Not all government expenditures have the same multiplier. Infrastructure projects, for example, tend to have a greater multiplier effect for several reasons:

They directly create jobs

They stimulate the supply chain, as raw and processed building materials, for example, are required for the project, thus stimulating economic activity in related industries.

Improved infrastructure (highways, ports, and broadband) enhances the efficiency of businesses, boosting private sector productivity and investment.

When all of this is taken into account, the total influence of government activity on GDP is roughly 35-40%. Trump’s careless smackdown on government spending will ripple throughout the economy if it is allowed to proceed.

And let’s be clear. Government expenditures will not cease immediately. But public confidence in the government will erode virtually immediately, increasing economic anxiety and decreasing people’s willingness to spend their money. The ripple effects will tank the economy as the multiplier effect decreases. This will be more obvious in areas that are more dependent on federal dollars. Here’s the map.

This map is particularly meaningful when you consider the results of the 2024 presidential election.

It’s tempting to call Trump a one-man wrecking ball. But he could not do this without the spineless GOP, which thought it could ride him to build a coalition that would last as long and be as productive as the New Deal Coalition that dominated American politics from the 1930s to the 1980s. But one important element is missing from this new coalition. Whereas the New Deal worked to improve the lot of average Americans – and stimulated the postwar economic boom that we all have ridden into the present – Trump 2.0 is about ripping away the gains of the past 75 years. The hit will land hardest on the people at the bottom of the economic ladder who voted for him because they wanted him to Make America Great Again.

Sorry-not-sorry.

Got that right! Good piece.

Yup! A lot of big oppsies!!!!! The confirmation hearings are another example. Sad but true. Comedy Central.